Skyrocketing Grocery Prices: A Look at Store Tactics

Written on

Understanding Grocery Pricing Strategies

Let's set aside the fact that soda—often referred to as "pop" in the Midwest—isn't the healthiest choice. Despite living in this region for 25 years, I steadfastly refuse to call it pop! People often tease me about it, but I remain unbothered.

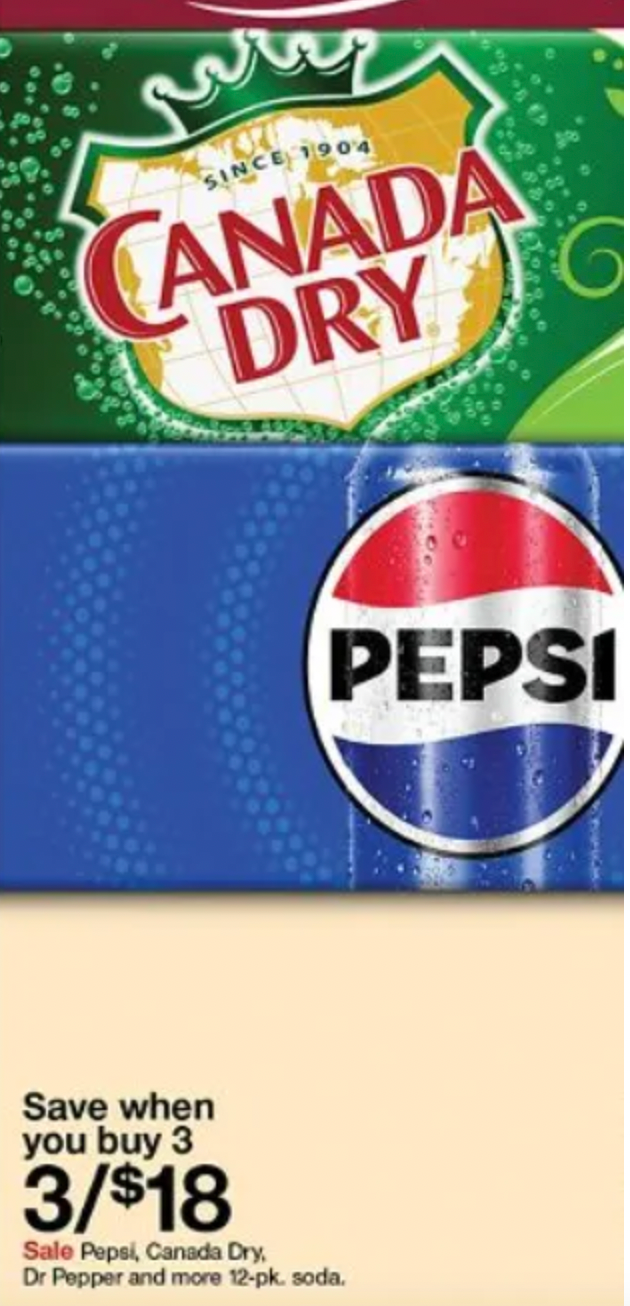

While browsing through a recent Target advertisement, I stumbled upon something shocking:

Can you believe it? $6 for a 12-pack is hardly a sale. Do they genuinely think shoppers are oblivious?

Perhaps they do. However, I certainly am not. I recall that before the pandemic, 12-packs of soda typically cost around $3 to $4. Back in 2011, I even found them for as low as $2 during a sale. Those days seem long gone. Although I enjoy Diet Coke, the rising costs have forced me to cut back, and it’s becoming absurd. Yes, I’m aware that Diet Coke isn't the healthiest choice either, but I resent it being lumped in with other unhealthy options like vaping, edibles, or alcohol.

But I digress; this so-called "sale" raises deeper concerns about the tactics stores employ against consumers.

Corporate Assumptions About Consumers

First and foremost, they seem to believe that American shoppers are uninformed. While some may not mind hunting for deals, many are becoming increasingly budget-conscious. Anyone who does their grocery shopping weekly can attest that something feels off.

It’s not merely due to the pandemic or labor shortages; it’s rooted in corporate greed.

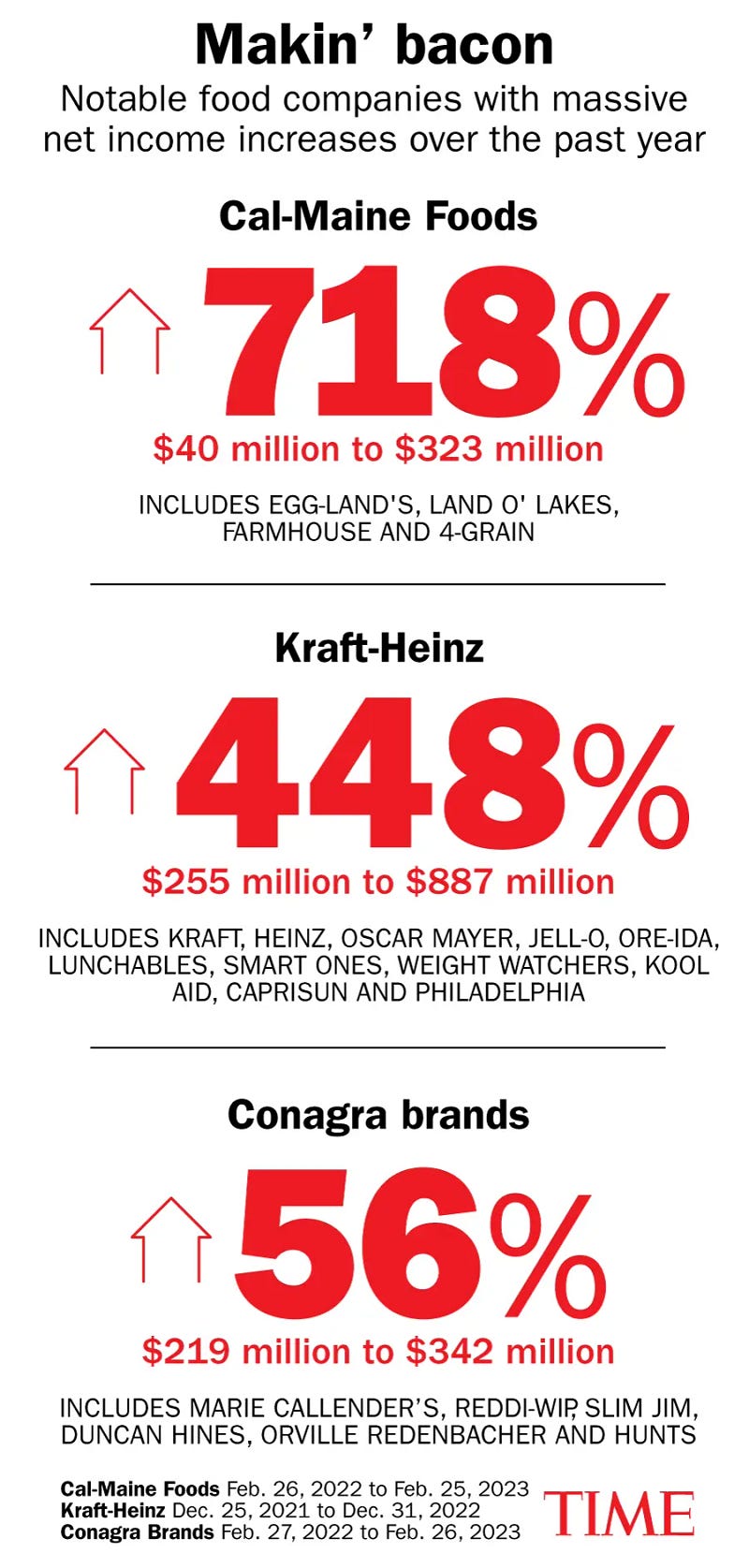

According to Time magazine, prices have surged significantly:

- A bag of chips that was once $5.36 is now $6.17.

- A dozen eggs that cost $2.01 now runs about $4.21.

- Butter has jumped from $3.77 to $4.87.

While grocery prices soar, major food corporations are amassing substantial profits. Experts assert that these profits contribute to higher grocery costs.

“Follow the money, and the story is clear,” tweeted former US Labor Secretary Robert Reich last week. “Food corporations are using inflation as a pretext to hike prices.”

Check out this chart:

As reported by CNBC in February, here’s how one company performed compared to Wall Street expectations based on analyst surveys:

- Earnings per share: 49 cents adjusted vs. 49 cents expected

- Revenue: $10.85 billion vs. $10.68 billion expected

Coca-Cola reported a fourth-quarter net income of $1.97 billion, down from $2.03 billion a year earlier. While consumers fret over affording their favorite drinks, corporations continue to profit immensely.

Consumer Reactions to Rising Prices

Second, they seem to think shoppers will accept these inflated prices indefinitely. Spoiler alert: most won’t. Eventually, the higher price tag may not justify the product. I’ve begun opting for generic brands instead of name brands, as the latter are no longer worth the cost.

From my experience as a deal hunter, consumers cannot simply coupon or wait for sales to offset these rising prices. Corporations need to curb their greed and recognize that consumers will eventually push back against such exorbitant price hikes.

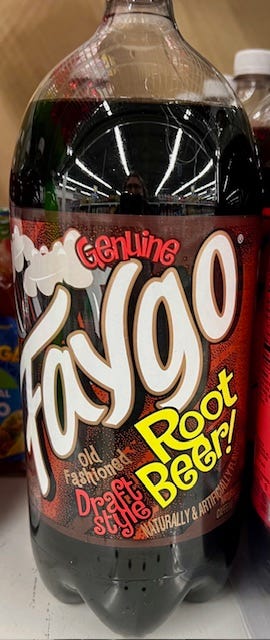

Now, if you'll excuse me, I’m off to grab a can of Faygo. I’m already trying to transition to more affordable brands.

Enjoying these insights? Click here!