Understanding Bitcoin: Lessons from a Childhood Bicycle Theft

Written on

Chapter 1: A Lesson in Security

Reflecting on my childhood, I often find myself nostalgic for the vibrant 80s. The unique style of that era still resonates with me, as I vividly recall every detail of my wardrobe—from the smell of my first leather jacket to the texture of my bombazine pants and the feel of my first All-Star Converse shoes.

One of my fondest memories is of the bicycle my parents gifted me. It had a long seat, allowing me to take a friend along—a true luxury at the time. The all-white frame with a blue stripe was the envy of my neighborhood. Everyone wanted a turn on that magnificent bike, which my father had ordered from Spain. The wheels were top-notch, and it boasted parts that none of us had seen before.

Among its features was a striking eight-number padlock, which I believed made my bike impenetrable. For weeks, I felt like royalty in my neighborhood, and even those who weren't fond of me wanted to befriend me, just for the chance to ride that beauty.

The padlock gave me a sense of security. I was confident I could leave my bike anywhere, protected by my memorable code: 19760312—my birthday. This illusion of safety led me to believe life would be free of worry.

However, that belief was shattered one summer day. After lunch, I rushed downstairs, eager for another adventure with my friends, only to discover my bike was missing. Panic set in as I searched the neighborhood, but it was gone—stolen. The excitement of summer turned into a season of sadness, leaving a lasting impact on me.

This experience taught me my first lesson about security. Fast forward 35 years, and I now grapple with new uncertainties—not regarding a simple padlock, but concerning public and private keys in the world of Bitcoin. These keys offer an encrypted solution to a digital currency that has captivated many.

In the 80s, our digital engagement revolved around games like Chuckie Egg on our Spectrum 128k. However, while we played, a revolution was brewing, led by brilliant minds who would eventually become billionaires. The World Wide Web, created by Tim Berners-Lee in 1989 at CERN, was initially intended to facilitate information sharing among scientists globally.

Years later, an individual known as Satoshi Nakamoto introduced a groundbreaking concept through a nine-page white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This document outlined a method for creating a digital currency, inspired by the economic downturn of 2008.

Nakamoto’s vision was clear: a decentralized form of electronic cash that would enable direct payments between parties without the need for banks. He pinpointed the inefficiencies in traditional transactions, highlighting how high mediation costs hindered smaller transactions and non-reversible payments.

For many in developing nations, Bitcoin represents a chance for financial freedom. While only 20% of Africans have bank accounts, two-thirds own mobile phones. This means that in regions lacking access to credit and insurance, a mobile device could become a transformative tool, facilitating trade without intermediaries and allowing users to access the blockchain for vital services.

In this new landscape, around 3 billion people without bank accounts could thrive with just a mobile phone and internet access. My childhood lesson about a stolen bicycle padlock led me to understand the importance of being prudent in the digital age.

So, where does one purchase Bitcoin? Unlike traditional banking, which is not the place to buy Bitcoin, various trading platforms such as Coinbase, Kraken, and Gemini exist. Even platforms like PayPal and Square have embraced Bitcoin.

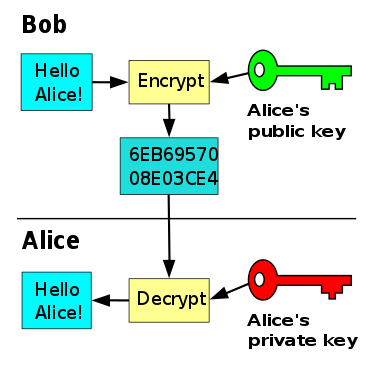

When dealing with cryptocurrencies, understanding public and private keys is essential. Your Bitcoin is safeguarded by these keys. If someone attempts to steal your crypto, they would need access to your private key.

In asymmetric key encryption, anyone can use a public key to encrypt messages, but only the holder of the private key can decrypt them. Thus, the security of your assets hinges on keeping your private key confidential.

Banks, while not inherently negative, charge fees for securing your funds. With digital currencies, you become the custodian of your assets by possessing your private key. It’s crucial to keep these keys secure in a Bitcoin wallet, just as you wouldn’t carry large amounts of cash casually.

There are three main types of wallets:

- Mobile Wallets: Ideal for quick transactions; utilize QR codes.

- Desktop Wallets: Offer full control but are vulnerable to malware.

- Hardware Wallets: Highly secure, suitable for storing larger amounts of Bitcoin.

I recently invested in a Ledger Nano X, a hardware wallet that allows me to buy and secure my cryptocurrencies seamlessly.

Bitcoin and cryptocurrencies represent a new technological frontier. Many people struggle to grasp their complexities, but understanding them is vital for safeguarding your future. Owning Bitcoin is akin to protecting yourself against future financial disparities.

In developing countries, Bitcoin is increasingly utilized for transactions, while in the West, it is often perceived as a hard asset—sometimes referred to as digital gold.

When discussing cryptocurrencies with friends, I often find their curiosity piqued, yet most are not investors. Many ordinary people are not inclined toward savings or investments, making them unlikely early adopters of Bitcoin. However, as companies like PayPal and Square integrate Bitcoin into their operations, this could change.

As Bitcoin's value rises against the U.S. dollar, it reflects the latter's weakening position. Once your Bitcoin is secure in your wallet, the best course of action is to forget about it.

With ongoing inflation and increasing inequality, investing time and energy into Bitcoin may offer a viable solution. Its finite supply—capped at 21 million coins—ensures that no third party can manipulate its availability, making it a fair asset governed by supply and demand.

Final Thoughts

In today's complex world, knowledge is your greatest ally. To safeguard your future and that of your family, continue learning about the financial system and its flaws. This understanding will naturally lead you to see Bitcoin as a valuable alternative.

The rise of decentralized finance is shifting how people engage with money, as evidenced by the actions of firms like PayPal and Square. Early adopters will reap the rewards, as has been the case throughout history.

While challenges lie ahead, the technological revolution promises to reshape entire industries. As we transition to a more digital existence, blockchain technology will usher in a new era, marking the advent of web 3.0 with innovations like Ethereum.

Ultimately, money represents our energy, time, and happiness. The question remains: how far will technology go in overcoming greed and the pursuit of power?

Join my email list for exclusive insights into my daily experiences and thoughts.

This article serves informational purposes and should not be construed as financial or legal advice. Always consult a financial professional before making significant financial decisions.

Chapter 2: Bitcoin Explained in 3 Minutes

Discover the basics of Bitcoin in this brief video that explains the key concepts and benefits of this revolutionary digital currency.

Chapter 3: Bitcoin for Kids: A Simple Guide

Learn how children can understand and engage with Bitcoin in this informative video tailored for younger audiences.