Maximize Your Cryptocurrency Earnings with Smart Strategies

Written on

Chapter 1: Introduction to Cryptocurrency Trading

The realm of cryptocurrency has revolutionized the financial landscape. With currencies like DogeCoin skyrocketing in value within days, one might wonder if there are still lucrative opportunities available. What if I told you that there is a viable method to capitalize on this market? If you’re intrigued, let’s dive in.

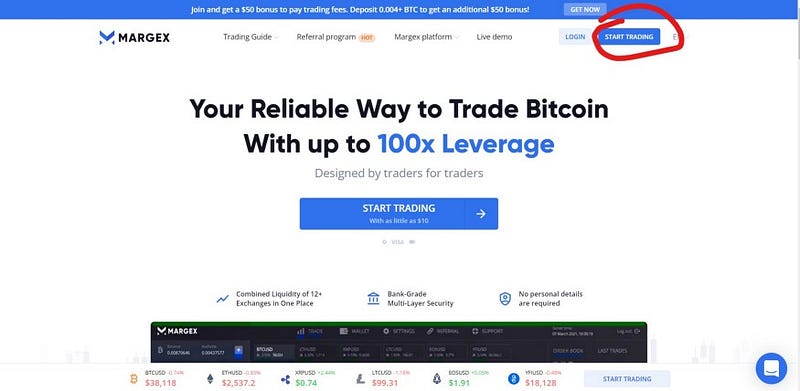

To begin, we will utilize a platform called Margex. Below, you’ll find a comprehensive guide to set up your Margex account effectively.

Step 1:

Visit Margex.com and select “Start Trading”.

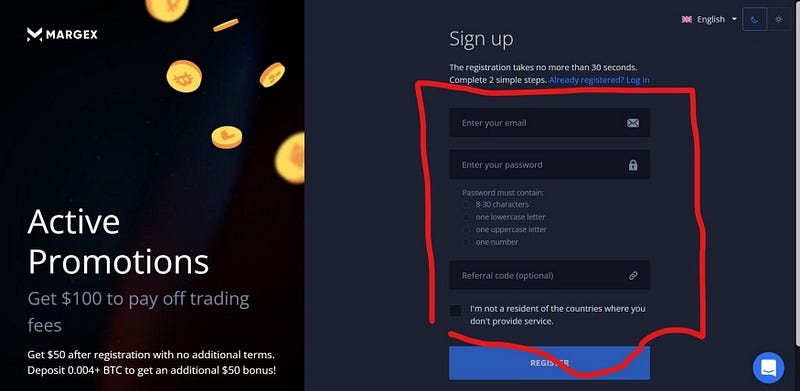

Step 2:

Fill in your desired credentials on the registration page.

Once you’ve completed the registration, you can begin trading after depositing Bitcoin into your account. When the Bitcoin appears in your “Wallet” tab, navigate to the “Trade” section on Margex and select Bitcoin from the available trading pairs.

Failure to select the correct trading pair linked to your deposit will prevent you from engaging in trades. In the trading interface, you will find a setting for the leverage of your order—ensure you adjust this to 100x.

This indicates that with a $100 deposit, you can trade as if you had $10,000 worth of Bitcoin, whether going long or short. Sounds impressive, right? However, there’s a catch. Trading with 100x leverage means that if, for instance, you invest $50 in a long position and Bitcoin drops by just 1% after 30 minutes, you will lose your entire investment. It's a high-risk game, so tread carefully.

In the stock market, a similar principle applies when margin trading. Before jumping into trades, it’s wise to use various indicators and limit each trade to only 5% of your total account balance. For example, with a $100 deposit, only trade with $5. This strategy ensures that while winning trades yield profits, losing trades won’t devastate your account.

Now that your Margex account is ready, let’s move on to actual trading.

Chapter 2: Utilizing TradingView for Effective Analysis

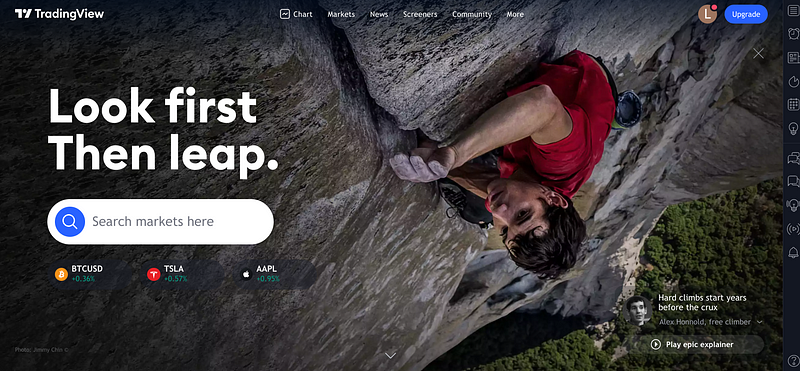

Next, you need to head over to TradingView. Here’s how to get started:

Sign up for a new account on TradingView. If you used the link provided earlier, you should have been redirected there. Please note that it’s a referral link, benefiting both of us if you register through it.

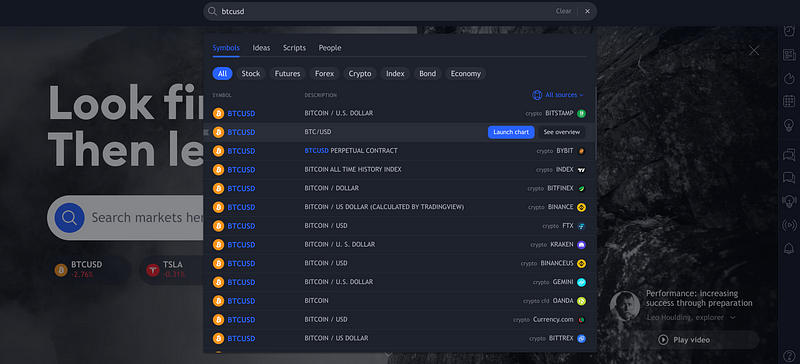

Once on TradingView, type BTCUSD in the search bar and choose the Coinbase data source.

You should arrive at a page similar to the one shown below:

Now, let's incorporate indicators. I’ve found great success with a strategy that utilizes the Keltner Channels and the RSI (Relative Strength Index). Set your timeframe to 1 minute to ensure optimal data accuracy. Click on “Indicators” in the top menu and select the aforementioned indicators.

Your screen should now resemble this:

Trading Parameters

Now for the exciting part—executing this straightforward yet potentially lucrative trading strategy.

100x Leverage Buy Parameters:

- The 14-period RSI for BTCUSD should be below 30.

- The price must close at least two bars beneath the lower Keltner Channel.

- Only proceed with buying when the RSI crosses above the yellow line, indicating a value greater than that shown on the line.

100x Leverage Sell Parameters:

- The 14-period RSI for BTCUSD should be above 70.

- The price must close at least two bars above the upper Keltner Channel.

- Only sell when the RSI crosses below the yellow line, meaning it is less than the value indicated on the line.

This strategy may seem overly simplistic, but that’s its strength. Complicated strategies rarely yield double-digit returns; instead, it’s the straightforward, comprehensible approaches that typically prove profitable.

Here are two scenarios within a two-hour window where profits could have been achieved—one where BTCUSD experienced a decline and another where it increased.

You’ve now uncovered a master strategy! One crucial piece of advice: don’t lose confidence when facing potential losses. Avoid exiting a trade simply due to fear of losing money; this behavior will invariably lead to losses.

Financial Disclaimer:

Please remember that this content does not constitute financial advice. It is essential to consult with a financial advisor or conduct your own research before making any investment decisions.

I hope this article provides you with a valuable resource to generate income and foster your financial growth. Important: This investment carries risks, and it’s vital to manage what you invest wisely.

If you found this article helpful, please share your thoughts in the comments and show your support!

If you’re new here, don’t forget to click that “Follow” button!

Thanks,

Jack Marque

Join Coinmonks on Telegram and YouTube to learn more about cryptocurrency trading and investing. Also, check out:

- How to trade Futures on FTX Exchange

- OKEx vs Binance

- ProfitTradingApp for Binance Review